Asset Liquidation Throughout Retirement: Does the Order Matter?

- Tim Owens

- Mar 23, 2023

- 3 min read

Updated: May 8, 2023

This blog analyzes the importance of knowing what assets to liquidate, and in what order, during retirement. The blog goes through a scenario of a couple who has over half a dozen different assets. However, the couple is unsure which of the assets they should use first to start funding their retirement. Picking the wrong order to liquidate your assets, as seen in this blog, could have huge implications for you and your loved one.

Are you in or nearing retirement, and wondering which asset to use first to fund your retirement? Does it even matter? You bet it does!

Below is an example illustrating the significance of knowing in which order to liquidate your assets during retirement.

Jim (66) and Camilla (64) married young, and Jim worked on his parents’ farm until his parents retired, while Camilla has worked various jobs in the education sector. In 2003, Jim took over his parents’ farm and has been running it with Camilla ever since. They recently retired and moved off the farm which their children now run. The assets that Jim and Camilla have acquired over the years to fund their retirement include:

Stocks: $200,000 (assumed 8% return; 1% dividend; 1% management fee)

Treasury Bonds: $250,000 (assumed 4% return)

Checking Account: $750,000 (0.02% return)

Roth IRA: $500,000 (assumed 7% return)

Traditional IRA: $1,200,000 (assumed 7% return)

Indexed Universal Life Cash Value: $350,000 with a $1 million death benefit (assumed 6.5% return)

Jim and Camilla’s desired income in retirement years is $150,000 a year, hedged at a 2% inflation rate. Now let’s examine how two different strategies do in their ability to fund Jim and Camilla’s retirement.

Strategy #1: Random Liquidation

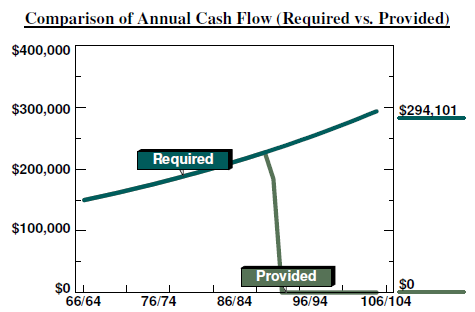

If you were to randomize your asset liquidation, this could be the result. As the graph below indicates, Jim and Camilla will run out of money at ages 88 and 86 respectively. The cumulative income until the couple runs out of money equals $4,278,000.

As you can see, the net worth of the couple and their assets liquidates quickly, and net worth passed on to heirs equals $0 should Jim and Camilla outlive ages 88/86.

Strategy #2: Strategic Liquidation

Now, what would happen if instead of “guessing,” the couple strategically liquidated their assets in the most efficient order? The difference is astonishing. First and foremost, Jim and Camilla can live comfortably to age 100 at their desired income, with more than enough money left in case of any emergency expenses. The total income they draw with this strategy is just short of $7,500,000, over a $3,200,000 increase from the other strategy.

Even so, Jim and Camilla are likely to have money left over for their heirs for when they pass away, an amount over $1,300,000 if they were to pass away at ages 101 and 99 respectively.

With over $1,300,000 in their Roth and Cash Value Life Insurance left, plus the death benefit of $1 million on the life insurance policy, they have over $2,300,000 of net worth that will pass on to their heirs. This is on top of the over $3,200,000 of extra retirement income provided for a total of over $5,500,000. Considering Jim and Camilla didn’t do anything but switch the order of asset liquidation, this outcome is astonishing.

Moral of the story. The order DOES matter.

Contact us today to discuss your financial plan!

(559) 322-2230

Comments